$293.00 and counting....I am rooting for under 21K really bad. Mr. Saylor helped talk a lot of people into crypto when it was at it's peak and I'd like to see him get whacked upside his head

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT- Bitcoin

- Thread starter redwine65

- Start date

I'm just going to put this here for those that might be interested.Fascinating reading about the layoffs and scams and potential huge margin calls for this miracle dust. If memory serves very early in this thread somebody eluded to whales letting retail in before they bought even more....looks like they snagged enough suckers to make bank while they exited.

Looks like he is attempting to cover every base for the foreseeable future so he can say "I called it" months later.

How would you boil that down in a few sentences?

Somewhat. He's taking a 10,000 ft view versus honing in on actual winners and losers. He wants us to begin to think differently in comparison to older models of thought.Looks like he is attempting to cover every base for the foreseeable future so he can say "I called it" months later.

How would you boil that down in a few sentences?

But he's right that the technology will continue to accelerate, whether it be crypto, advances in biosciences, AI, robotics, energy or automation. None of that stuff is going to fizzle out and disappear. But which companies will win? And which legacy companies will disappear? In most segments, there are typically two major players and a bunch of wannabes.

Network Effects.Looks like he is attempting to cover every base for the foreseeable future so he can say "I called it" months later.

How would you boil that down in a few sentences?

It's the reason Twitter or Facebook, or Inside Nebraska is valuable.

He cite's Metcalfes's law, which says the value of a network is proportional to the square of its number of users

This is also a way to look at how value is derived in the crypto market.

Many of the cryptos out there are indeed garbage, but those that end up surviving and providing utility, are going to become immensely valuable.

Another short vid with more specifics on crypto:

Last edited:

I wonder what the bottom is? It would certainly be unnerving to hold.Who else is enjoying watching this train wreck?

I wonder what the bottom is? It would certainly be unnerving to hold.

Don't ask the same guys who told you it was going to 6 figures....hahahaha. Saylor has to be shitting his pants right now. I think there is a lot more room to fall personally.

Why are so many BTC firms going BK? Celsius is the latest in a very very long line....why is this happening? Anyone? Bueller?

leverageWhy are so many BTC firms going BK? Celsius is the latest in a very very long line....why is this happening? Anyone? Bueller?

- Michael Saylor, MicroStrategy's founder, will give up the role of CEO on Monday.

- The software firm posted an impairment charge of $917 million related to its investment in bitcoin.

HAHAHAHAHA

I bought ETHE (Etherium on TD Ameritrade) @ 8.12 per share on June 13th. Long term trendline is holding and I will be holding this for probably a long time. I know BTC was hitting about the same trendline also and should’ve probably got an equal chunk of that.

this kind of thing just amazes me..I bought ETHE (Etherium on TD Ameritrade) @ 8.12 per share on June 13th. Long term trendline is holding and I will be holding this for probably a long time. I know BTC was hitting about the same trendline also and should’ve probably got an equal chunk of that.

What you did, was buy a derivative of Eth, one that is controlled 100% by Ameritrade directly.

You don't own any keys to any coins either, rather shares in an etf.

One of the main reasons crypto was developed was to remove 3rd party / counter party risk.

Did you not see Celsius and other firms file for bankruptcy recently?

All those customers of those firms also got rekt, because their assets are not insured and they are considered 'unsecured creditors' of those firms, meaning you are in the last group that gets to make claims on the remaining assets left in a company once it goes bankrupt.. ie, you get nothing.

Yes, I’m aware that it’s a derivative/ETF. The reason these firms went bankrupt (TD did not) is because the price completely tanked. I won’t even be holding it through that big of a tanking. I’m going to trust TD Ameritrade and their derivative on this one. I’ve been trading with them for a long time and they’ve been great.this kind of thing just amazes me..

What you did, was buy a derivative of Eth, one that is controlled 100% by Ameritrade directly.

You don't own any keys to any coins either, rather shares in an etf.

One of the main reasons crypto was developed was to remove 3rd party / counter party risk.

Did you not see Celsius and other firms file for bankruptcy recently?

All those customers of those firms also got rekt, because their assets are not insured and they are considered 'unsecured creditors' of those firms, meaning you are in the last group that gets to make claims on the remaining assets left in a company once it goes bankrupt.. ie, you get nothing.

There have been many cases of coinbase and other methods of holding actual crypto getting stolen anyways. It’s a risk you take investing in something that isn’t even real to begin with. I’m not worried about it in the slightest and I’ll let you know how it pans out, but thanks for the tip.

Chain Announces Multi-Year Partnership with Kraft Sports + Enter

<[Saint Kitts and Nevis] (September 22, 2022)> Chain, the leading Web3 software solutions company and Kraft Sports + Entertainment are excited to announce a mul...

I'm still not feeling like I was left out. Maybe someday though....Its cryptocurrency and you will be left out. Your decision.

Through all of this, adoption has not stopped. Pretty strong indicator.

Greater fool theory.

Don't get me wrong. In a world with what, 8 billion people?, there is still plenty of room to grow and make money off of the re-selling of magic beans.

Why are so many BTC firms going BK? Celsius is the latest in a very very long line....why is this happening? Anyone? Bueller?

Because they are only stable while crypto prices are rising. Once losses continue for a prolonged period, they can no longer afford to pay out their crazy high promised interest and when that happens, the house of cards collapses.

It is similar to why the housing market collapsed in 2008.

Ignorance truly must be bliss.Because they are only stable while crypto prices are rising. Once losses continue for a prolonged period, they can no longer afford to pay out their crazy high promised interest and when that happens, the house of cards collapses.

It is similar to why the housing market collapsed in 2008.

There is a possibility btc goes down further from here. I wouldn't buy until the Fed stops raising rates or pivots to start lowering them.

The upside potential is also not as high as it used to be. As BTC matures, the volatility will diminish, but so will its gains. Next bull run highs are likely only in the mid to upper 80K range based on these diminishing returns (aka only a 4-7x range (depending on the low) vs the last 22x bull run cycle.

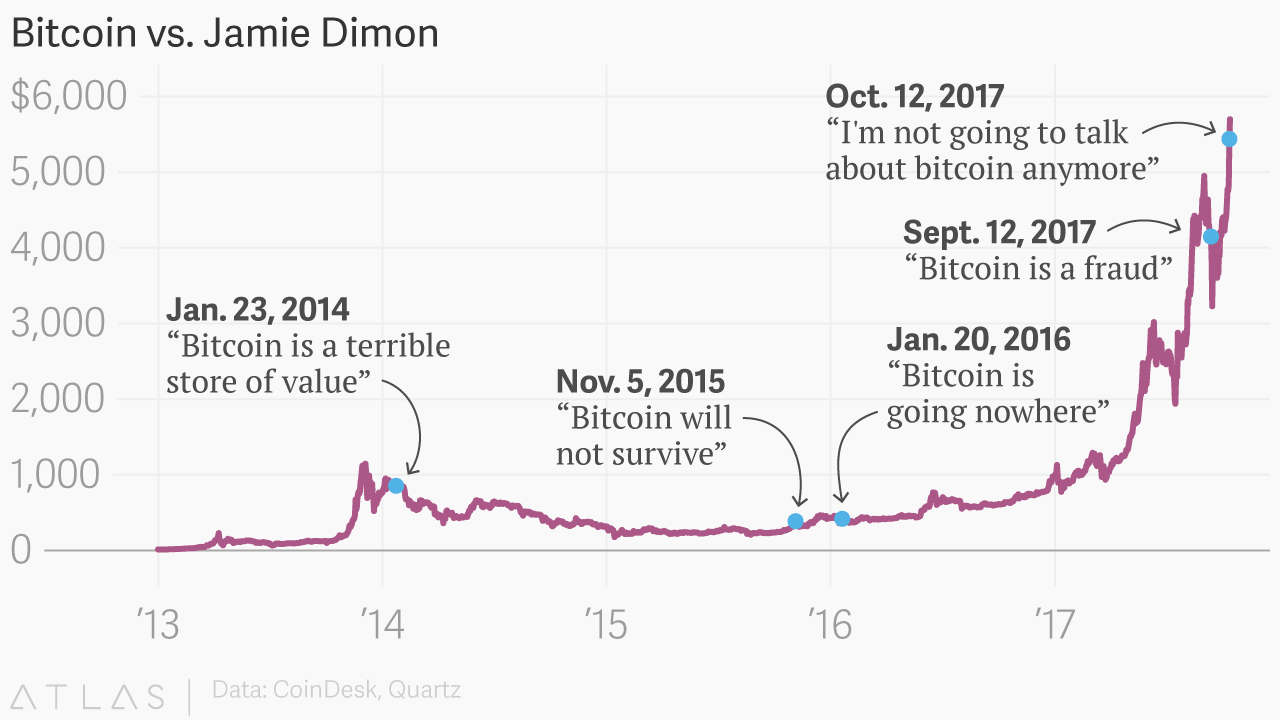

Most of the major banks, are publicly bad mouthing bitcoin, but are privately buying. So there is that.

The upside potential is also not as high as it used to be. As BTC matures, the volatility will diminish, but so will its gains. Next bull run highs are likely only in the mid to upper 80K range based on these diminishing returns (aka only a 4-7x range (depending on the low) vs the last 22x bull run cycle.

Most of the major banks, are publicly bad mouthing bitcoin, but are privately buying. So there is that.

Bitcoin growth typically happens in a 10 day period.There is a possibility btc goes down further from here. I wouldn't buy until the Fed stops raising rates or pivots to start lowering them.

The upside potential is also not as high as it used to be. As BTC matures, the volatility will diminish, but so will its gains. Next bull run highs are likely only in the mid to upper 80K range based on these diminishing returns (aka only a 4-7x range (depending on the low) vs the last 22x bull run cycle.

Most of the major banks, are publicly bad mouthing bitcoin, but are privately buying. So there is that.

I don't expect the Fed will lower rates.

I don't understand what you're saying in the first sentance. BTC actually goes up and down in cycles. The bull runs typically take place after a halvening, where it becomes more difficult to mine.Bitcoin growth typically happens in a 10 day period.

I don't expect the Fed will lower rates.

The Feb probably won't lower rates the first time, but they will pause on raising them. Eventually, they will have to ease at some point.

I've been in Bitcoin since 2009. I know about halvings. I've stumbled around and done pretty well.I don't understand what you're saying in the first sentance. BTC actually goes up and down in cycles. The bull runs typically take place after a halvening, where it becomes more difficult to mine.

The Feb probably won't lower rates the first time, but they will pause on raising them. Eventually, they will have to ease at some point.

The Fed is trapped.

Crypto adoption will continue. The only thing that will stop bitcoin from going up over the long term is if people move on to another token entirely.

Ignorance truly must be bliss.

Uh huh. How is your Celsius account doing?

Ignorant and unintelligent. The total package!Uh huh. How is your Celsius account doing?

Ignorant and unintelligent. The total package!

Yes, that is the tried and true, all-purpose crypto response: "you are just too stupid to understand".

Good luck hodling, Super Genius.

The bear market low has either already happened as it seems to have hit between 17 and 20k multiple times in the last 4 months. That is typically a sign the market is over sold. I do however thin there is a lot of uncertainty going around so it may take a little longer than years past to break out of it. It also is not a bad time to buy right now, because I think it will be higher at the halving point then it is right now. I believe between now and the bitcoin halving will be the time to buy. I have been DCAing since JanuaryI don't understand what you're saying in the first sentance. BTC actually goes up and down in cycles. The bull runs typically take place after a halvening, where it becomes more difficult to mine.

The Feb probably won't lower rates the first time, but they will pause on raising them. Eventually, they will have to ease at some point.

good strategy.. it could go lower some say, others say the bottom is in.The bear market low has either already happened as it seems to have hit between 17 and 20k multiple times in the last 4 months. That is typically a sign the market is over sold. I do however thin there is a lot of uncertainty going around so it may take a little longer than years past to break out of it. It also is not a bad time to buy right now, because I think it will be higher at the halving point then it is right now. I believe between now and the bitcoin halving will be the time to buy. I have been DCAing since January

One thing, the S&P just had what is called a death cross, so generally it means a big selloff is coming within the next couple of months (maybe end of year?) for the S&P 500.

Bitcoin has moved with or ahead of the stock market, so there could be more downside risk. The other consideration is, btc is already down by a large percentage, while stocks haven't caught up yet, so who really knows?

If BTC does go down, it probably won't stay down for long, meaning a guy might have to have some standing orders in to try and catch it as it wicks down to 12-13k before it goes back up.

BTC probably wont have another major bull run until after the next halvening, which is estimated around March 2024, and then it usually doesn't start until 6+ months after that event, so I don't see any major moves for BTC for the next 2 years.

If the financial world starts to fall apart, or governments ban crypto, things could change a lot before then, in either direction.

Starting to look at some Bitcoin targets at $17k, $9k, and $3.5k. Ironically the only hope Bitcoin has is if the Fed turns the hose back on.

$17k officially hit. I know we got close a few months ago but just checking in on my favorite thread. Everybody that's been buying and DCAing above here...good luck. Downside can be swift and ruthless if we get some more...

Why are so many BTC firms going BK? Celsius is the latest in a very very long line....why is this happening? Anyone? Bueller?

This is typically what happens to ponzi schemes. Another one bites the dust...

Amazing how many of these firms were propped up by 0% rates.This is typically what happens to ponzi schemes. Another one bites the dust...

Did you catch that 40% jump in BIIB a couple weeks ago?

Amazing how many of these firms were propped up by 0% rates.This is typically what happens to ponzi schemes. Another one bites the dust...

Did you catch that 40% jump in BIIB a couple weeks ago?

Similar threads

- Replies

- 21

- Views

- 1K

Recruiting New 2026 OT offer

- Replies

- 1

- Views

- 765

ADVERTISEMENT

ADVERTISEMENT