Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

OT- Bitcoin

- Thread starter redwine65

- Start date

Been a few hours since my post...how we doin' here?

If we break 30k I'm pretty certain 20k is guaranteed. Lot of pain there I believe this thread was started around $30k price point...

I think it's possible to eventually come back down and test the 20K level as support, which it hasn't really done yet. In the interim, it has to break 40k and 31k in order to do that

If we break 30k I'm pretty certain 20k is guaranteed. Lot of pain there I believe this thread was started around $30k price point...

What is your take on the viability of stable coins?.. Tether has been talked about and targeted for years, with no negative results yet, but it's on my mind a lot that maybe holding USDT is not such a good idea right now.Been a few hours since my post...how we doin' here?

If we break 30k I'm pretty certain 20k is guaranteed. Lot of pain there I believe this thread was started around $30k price point...

I think this is bigger than crypto, as risky assets in general have been selling off pretty hard. Kyle Bass's tweet below shows that. It's good to get some of the leverage out of the markets either way. I used to see tweets from people going with 50x leverage in crypto and it looks like a lot of those trades have been ending exactly the way one would expect them to end.

@NYC-Husker, yeah, I had a stock I bought last year called Enovix or something like that. They were doing something related to batteries for EVs. Bought around $19.xx and watched it hit $38 in like a month. Started to fall so I sold at $35. Now it's at $16. There's nothing there, these companies are over-valued. I'm shorting a few growth companies too, triple-digit stock prices for companies losing money just doesn't make sense. The crash should be huge.

It’s a healthy market correction, nothing more. Trees don’t grow straight to the sky, it needed to take a breath. Interest rates needed to come off the bottom. Inflation is a concern but not as bad as they are making it. Earnings are going to remain strong this year. Answer this, Where are people going to put their money? You going to sit in cash with a 5-7% inflation number? That’ll cost you a lot of money. You going to buy CD’s and treasury bonds paying 2%? Thats still a big negative real return. Equities remains the best place to have the majority of your wealth. High paying deep value stocks will still return near double digits this year. This is a healthy pullback and if you’re sitting on a pile of cash for some reason, I’d start taking positions right about now

Define "deep value" stocks. : - ) Microsoft's run the past 12 months was nice, but that can't continue. I like the company, but they have to pull back into the low 200's? I'm looking for low P/E ratio stocks - a few REITs look good right now.It’s a healthy market correction, nothing more. Trees don’t grow straight to the sky, it needed to take a breath. Interest rates needed to come off the bottom. Inflation is a concern but not as bad as they are making it. Earnings are going to remain strong this year. Answer this, Where are people going to put their money? You going to sit in cash with a 5-7% inflation number? That’ll cost you a lot of money. You going to buy CD’s and treasury bonds paying 2%? Thats still a big negative real return. Equities remains the best place to have the majority of your wealth. High paying deep value stocks will still return near double digits this year. This is a healthy pullback and if you’re sitting on a pile of cash for some reason, I’d start taking positions right about now

But I agree, people have to put their money somewhere. Just wondering if the drop in crypto is to make way for big institutions to get in at a great price?

You mention low P/E which is one if the main characteristics of value stocks. Look for companies that will thrive in a rising rate, rising oil price environment. We’ll easily have $100+ oil by the summer. The big energy companies are a great play right now. A lot of the banks look attractive here. Heck, some of the tech names that have been pummeled that I never had a chance to own are starting to look good here. Netflix has been cut in half and that company is printing money. Regarding crypto, its amazing how correlated it’s become with the stock market, and that’s because of all the institutional money in it now. It just moves at about a 4x rate to that of the stock market. S&P goes down 10%, Bitcoin probably drops at least 40% and the same on the upside

A simple accident30% of the dollar supply has been made since the ccp wuhan lab/meat market bat virus

Whatever and whenever the bottom hits, the opportunity to get in or increase a position will be unprecedented. Especially in BTC, ETC, SOL and other more stable coins. Coinbase is at $186 right now. Crazy. Kids and their memecoins are taking some serious hits as well. Kinda deserve it though.

Same situation in the market. Tremendous opportunity is afoot and I’m here for it.

Same situation in the market. Tremendous opportunity is afoot and I’m here for it.

Baseball basketball cards have seen record valuations.This reminds me of the crash of baseball cards and comic books.

No doubt all of this is pushed by money supply to some effect.

I view NFTs as more comparable to cards and comics, not crypto so much. Eventually, BTC will be used as currency in some form almost everywhere. Can’t buy a cart of groceries with an UD Griffey jr rookie card.This reminds me of the crash of baseball cards and comic books.

Bitcoin $34.5k today less than 48 hours after the distress signal was given! Even though $35k was the target area and a ton of "indicators" might tell you otherwise, I would not be buying here. Seeing over $1B in liquidations but bigger fish are still in the pool.

And that's the tough part. Where/when is the bottom? There are a couple recently high-profile players that will go bust first, IMO. At that point you can assess whether things are at a place where you want to INVEST. The environment will certainly be great for short-term trading until then.

I enjoyed the metaverse the first time around when it was called the WORLD WIDE WEB. They have been pushing this AI hype for the past decade but it's already petered out. I remember they did the same thing in the 80's. Remember the movie The Lawnmower Man?

Whatever and whenever the bottom hits, the opportunity to get in or increase a position will be unprecedented. Especially in BTC, ETC, SOL and other more stable coins. Coinbase is at $186 right now. Crazy. Kids and their memecoins are taking some serious hits as well. Kinda deserve it though.

Same situation in the market. Tremendous opportunity is afoot and I’m here for it.

And that's the tough part. Where/when is the bottom? There are a couple recently high-profile players that will go bust first, IMO. At that point you can assess whether things are at a place where you want to INVEST. The environment will certainly be great for short-term trading until then.

I think it's clear the crypto market is evolving. It's no longer about just Bitcoin and Ethereum.

Things like metaverse and AI are just being born now.

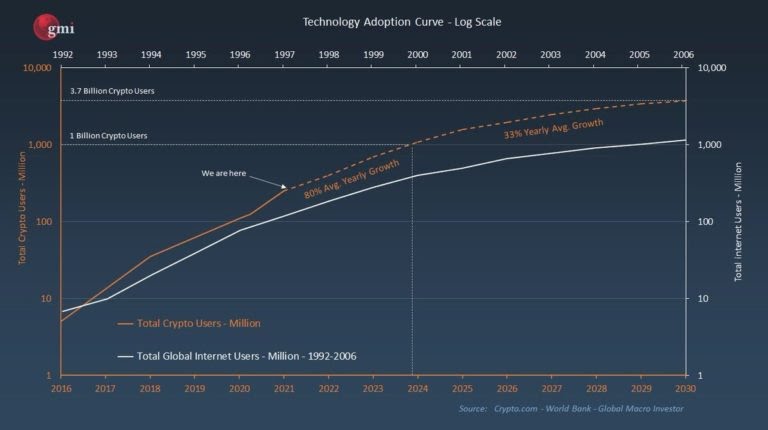

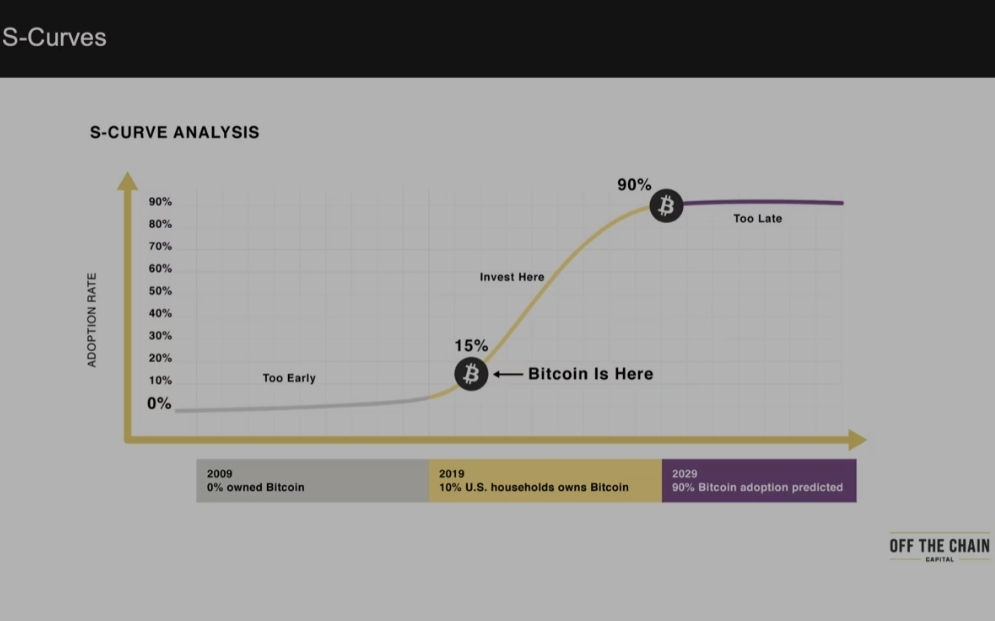

Here are a couple metrics:

I enjoyed the metaverse the first time around when it was called the WORLD WIDE WEB. They have been pushing this AI hype for the past decade but it's already petered out. I remember they did the same thing in the 80's. Remember the movie The Lawnmower Man?

What is your take on the viability of stable coins?.. Tether has been talked about and targeted for years, with no negative results yet, but it's on my mind a lot that maybe holding USDT is not such a good idea right now.

They just denied another Bitcoin ETF because of Tether manipulation. And speaking of Tether:

I don't really have a take on the viability of stable coins because the only one I'm really familiar with is Tether and things are obviously not above board there.

No I don't remember lawnmower man 🤣🤣🤣Bitcoin $34.5k today less than 48 hours after the distress signal was given! Even though $35k was the target area and a ton of "indicators" might tell you otherwise, I would not be buying here. Seeing over $1B in liquidations but bigger fish are still in the pool.

And that's the tough part. Where/when is the bottom? There are a couple recently high-profile players that will go bust first, IMO. At that point you can assess whether things are at a place where you want to INVEST. The environment will certainly be great for short-term trading until then.

I enjoyed the metaverse the first time around when it was called the WORLD WIDE WEB. They have been pushing this AI hype for the past decade but it's already petered out. I remember they did the same thing in the 80's. Remember the movie The Lawnmower Man?

Web1 was the world wide web.

Web2 was/is ecommerce

Web3 will be AI - this stuff is coming.

Idk what it's going to do, but its clear crypto is more than a fad.

I was in college in the 90's and all I remember hearing is that the world wide web was supposed to be a decentralized and free place for everyone to share information. That was before big tech companies took it over to maximize ad revenue.

I don't see how these same big tech companies pouring all this money into the metaverse will make it a better place. I think greed will take over again and things will eventually go back to being more centralized just like what happened with the Web after the 90’s.

And I don’t get how cryptocurrency is considered scarce. Gold is scarce because you can’t make more of it. You can’t make a gold 2.0 to correct problems with gold, make a copycat of gold, or manipulate the rules to make more gold.

I know this stuff isn’t going away, I just don’t think it’s going to free us from big corporations and government regulations like they claim it will.

I don't see how these same big tech companies pouring all this money into the metaverse will make it a better place. I think greed will take over again and things will eventually go back to being more centralized just like what happened with the Web after the 90’s.

And I don’t get how cryptocurrency is considered scarce. Gold is scarce because you can’t make more of it. You can’t make a gold 2.0 to correct problems with gold, make a copycat of gold, or manipulate the rules to make more gold.

I know this stuff isn’t going away, I just don’t think it’s going to free us from big corporations and government regulations like they claim it will.

99% of gold is still in the ground.I was in college in the 90's and all I remember hearing is that the world wide web was supposed to be a decentralized and free place for everyone to share information. That was before big tech companies took it over to maximize ad revenue.

I don't see how these same big tech companies pouring all this money into the metaverse will make it a better place. I think greed will take over again and things will eventually go back to being more centralized just like what happened with the Web after the 90’s.

And I don’t get how cryptocurrency is considered scarce. Gold is scarce because you can’t make more of it. You can’t make a gold 2.0 to correct problems with gold, make a copycat of gold, or manipulate the rules to make more gold.

I know this stuff isn’t going away, I just don’t think it’s going to free us from big corporations and government regulations like they claim it will.

Crypto is only scarce if the project decides to make it scarce. Bitcoin will only have 21 million tokens max.

Shib has trillions.

I've been doing some research to find safer stable coins, and came across UST (stable coin from the Terra Luna family) and another called PAXG (Pax Gold) which sort of acts like a stable coin supposedly backed by gold.They just denied another Bitcoin ETF because of Tether manipulation. And speaking of Tether:

I don't really have a take on the viability of stable coins because the only one I'm really familiar with is Tether and things are obviously not above board there.

I'm finding myself wanting to diversify so that my holdings are not in any 1 or 2 stable coins, or even 1-2 exchanges/wallets.

After the Metamask hack last year, I have trust issues with just about any wallet, esp those that connect to a DEX. I don't trust keeping a lot at any one exchange either.

I agree.. this tech can and probably will be used to enslave people more than it will to liberate.I was in college in the 90's and all I remember hearing is that the world wide web was supposed to be a decentralized and free place for everyone to share information. That was before big tech companies took it over to maximize ad revenue.

I don't see how these same big tech companies pouring all this money into the metaverse will make it a better place. I think greed will take over again and things will eventually go back to being more centralized just like what happened with the Web after the 90’s.

And I don’t get how cryptocurrency is considered scarce. Gold is scarce because you can’t make more of it. You can’t make a gold 2.0 to correct problems with gold, make a copycat of gold, or manipulate the rules to make more gold.

I know this stuff isn’t going away, I just don’t think it’s going to free us from big corporations and government regulations like they claim it will.

It's easy to fork a coin, or a whole ecosystem.

That didn't take long for bitcoin to bounce about 12% off the low.

If this holds it'll be yet another higher yearly low.

If this holds it'll be yet another higher yearly low.

Translation....we want to control everything and know what's best for you.

just a little gov't beak-wetting, nothing to see hereTranslation....we want to control everything and know what's best for you.

Next week should be fun. Narratives being built for a move with this White House thing.

I will only be concerned about the downfall of crypto if a crusty, chain smoking pillow salesmen says it’s so. Until then, I’m on board:Next week should be fun. Narratives being built for a move with this White House thing.

Still working out for you?I will only be concerned about the downfall of crypto if a crusty, chain smoking pillow salesmen says it’s so. Until then, I’m on board:

Wow, words of wisdom here, you sound just like Charlie Munger and Buffett!Wow, alot of sheep about to be slaughtered on BitCoin. When , I can't tell you exactly but it's inevitable. The fair intrinsic value is $0. There is an infinite supply of digital coins exactly like Bitcoin, but with different names. Infinite easy copy and paste supply of digital coins exactly the same as Bitcoin but with different names. Digital coins are assets, not a currency, and it's an asset with no value with infinite supply of digital coins.

There is nothing behind Bitcoin, nothing supporting it but cult followers who think an interesting IT nerd computer program is something special. Bitcoin is RAT POISON.

We already have a digital currency. When the US Fed Res starts talking about cashless all digital US Dollar, ie. ban physical cash, Bitcoin will go to $0 if it isn't already there..

Lol. Viewing investments and value through a short term lens is a bold strategy…… Correction, bad strategy. And to be clear, I would suggest having no more than 20% of any portfolio, at any time, in crypto. BTC and ETH could explode by June and I still wouldn’t go all in.Still working out for you?

Agreed. Never get in too deep with a digital ponzi scheme.Lol. Viewing investments and value through a short term lens is a bold strategy…… Correction, bad strategy. And to be clear, I would suggest having no more than 20% of any portfolio, at any time, in crypto. BTC and ETH could explode by June and I still wouldn’t go all in.

Sydney Powell still working out for you?Still working out for you?

Tell me your only knowledge of Bitcoin is from one Youtube video of Warren Buffet talking about Bitcoin 4 years ago without telling me you watched one Youtube video of Warren Buffet talking about Bitcoin 4 years agoWow, alot of sheep about to be slaughtered on BitCoin. When , I can't tell you exactly but it's inevitable. The fair intrinsic value is $0. There is an infinite supply of digital coins exactly like Bitcoin, but with different names. Infinite easy copy and paste supply of digital coins exactly the same as Bitcoin but with different names. Digital coins are assets, not a currency, and it's an asset with no value with infinite supply of digital coins.

There is nothing behind Bitcoin, nothing supporting it but cult followers who think an interesting IT nerd computer program is something special. Bitcoin is RAT POISON.

We already have a digital currency. When the US Fed Res starts talking about cashless all digital US Dollar, ie. ban physical cash, Bitcoin will go to $0 if it isn't already there..

Bitcoin has zero intrinsic value, you might as well buy some pet rocks. LOL only countries with worthless currencies adopt bitcoin.Tell me your only knowledge of Bitcoin is from one Youtube video of Warren Buffet talking about Bitcoin 4 years ago without telling me you watched one Youtube video of Warren Buffet talking about Bitcoin 4 years ago

I hear the beanie baby market is heating up again.Bitcoin has zero intrinsic value, you might as well buy some pet rocks. LOL only countries with worthless currencies adopt bitcoin.

Similar threads

- Replies

- 5

- Views

- 334

- Replies

- 0

- Views

- 314

- Replies

- 4

- Views

- 298

- Replies

- 2

- Views

- 396

ADVERTISEMENT

ADVERTISEMENT