Howdy Huskers, I come in peace. Below I have copied 'n pasted a recent column by Frank The Tank. Near the bottom he mentions Colorado as a potential B1G expansion school. I have also heard this from a Buffalo alum/insider who said that jumping to the B1G has been discussed at UC BOT meetings. Major issues are that the P12 Network is a train wreck while BTN is a huge success, conference TV revenue same story, Pacific Time Zone, D1 hockey conference (UC currently D3) and better academic fit. Have you guys heard anything about this from your old Colorado buddies?

Tank text begins:

Over the past several years analyzing conference realignment, observers have had access to some overarching data, such as TV ratings, athletic department revenue, population and demographic trends of states and metro areas, and the home states of current college students. However, up to this point, there has been only largely anecdotal and/or unreliable data on a critical piece of the conference realignment puzzle: the specific places where the graduates from each college actually live. As an Illinois graduate, I've long known anecdotally that my alma mater sends a critical mass of graduates to San Francisco and Seattle (generally for tech jobs due to the school's strong engineering and computer science programs) while very few Illini move to Indianapolis despite it actually being geographically closer to campus than Chicago and St. Louis, but it has been difficult to find quantitative data to actually back that up.

This is where a new database from the Wall Street Journal fills the gap.* The Journal worked with a labor market research firm to identify the metro areas where the graduates of 445 colleges now live. It breaks down the most popular locations for the alumni for each school to move to in the United States. What's also interesting is to see how certain locations are conspicuously devoid of particular schools' alums, which we'll discuss in a moment.

(* h/t to Aaron Renn for his original post on this Wall Street Journal database. If you're interested in urban development and demographic issues, he is one of the best writers out there.)

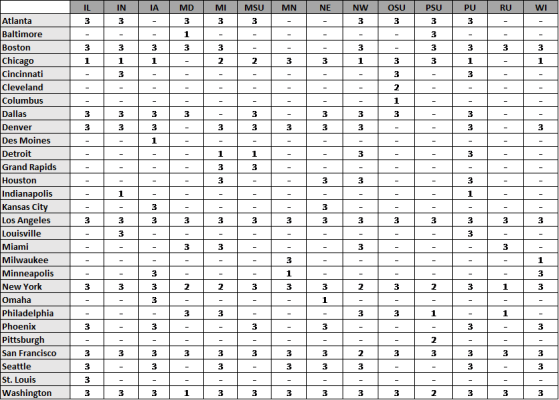

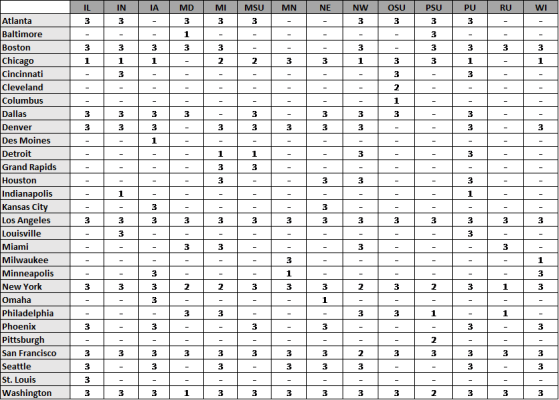

For someone that's interested in conference realignment and the college sports business in general, this database is a legitimate treasure trove. As soon as I was made aware of this Journal site, I went through each of the Big Ten schools to identify the top metro areas for each of their respective graduates. Here is the chart I put together with each of the Big Ten schools on top, applicable metropolitan areas listed on the side, and a tier number assigned whenever a market comes up as a top destination for a school's graduates:

Key:

Tier 1 = 10% or more of a school's graduates live in that market

Tier 2 = 5% - 9.99% of a school's graduates live in that market

Tier 3 = 1% - 4.99% of a school's graduates live in that market

Dash = Not a measurable destination for a school's graduates

After creating this chart in my full dorkdom, there are some key takeaways:

FOUR CITIES ARE TOP DESTINATIONS FOR ALL BIG TEN SCHOOLS... AND NONE OF THEM ARE IN THE MIDWEST

There are only four markets in the entire country that drew more than 1% of the graduates from every single Big Ten school: New York, Los Angeles, Washington and San Francisco. None of these metro areas are located in the Midwest. Not even Chicago, the heart of the Big Ten, covered every single conference school, albeit the two sub-1% exceptions are the latest East Coast additions of Maryland and Rutgers.

To be sure, the Wall Street Journal notes that those four particular markets draw from a much wider range of colleges across the country. The sheer sizes of the New York and Los Angeles markets swallow up a lot of college grads and all four of the cities have strengths in industries that attract a national talent pool: finance in New York, entertainment in Los Angeles**, tech in San Francisco, and government and politics in Washington.

(** My favorite Big Ten-to-Hollywood story at the moment: former Penn State basketball player Joonas Suotamo is taking over the role of Chewbacca. Also, while this isn't reflected in the domestic data, the Big Ten will have a monopoly on Americans in the British royal family after this weekend when Hollywood actress and Northwestern alum Meghan Markle marries Prince Harry.)

Still, the Big Ten's top-to-bottom presence in those four markets is noteworthy because the only other Division I conference that has every member in those same markets is the Ivy League... and all of the Ivy League schools are in relatively close proximity to New York and Washington. Interestingly enough, all of the Ivy League schools have at least a Tier 3 presence in Chicago, too.

BIG TEN GRADS LARGELY STAY IN THEIR HOME STATES, GO TO CHICAGO, OR LEAVE THE MIDWEST COMPLETELY

Putting aside Maryland and Rutgers, Chicago is still the market with the deepest ties to the Big Ten by a large margin. It is a Tier 1 market for 6 schools, Tier 2 market for 2 schools and Tier 3 market for 4 schools. No other metro area has more than 2 Tier 1 Big Ten school connections. This isn't exactly surprising with the annual migratory pattern of new Big Ten grads taking over apartments in Lincoln Park and Lakeview every summer (while the older Big Ten grads like me move on to places like Naperville).

Big Ten schools also send a lot of grads to the largest metro areas within their own home states. Every Big Ten school has a Tier 1 connection to at least one market located in its home state. Note that there are many metro areas where the principal city is located in one state but parts of its market are located in another state. New Jersey is a classic example where it's largely split between the New York and Philadelphia metro areas. There are several other border areas in the Big Ten footprint such as the St. Louis metro area being partially in Illinois, the Louisville and Cincinnati metro areas crossing into Indiana. Ultimately, a state keeping a large number of grads from its flagship or other large schools isn't exactly surprising, either. Going home will always be a strong draw.

What's stunning to me, though, is the utter lack of Big Ten grads going anywhere else in the Midwest other than Chicago or a metro area that has a presence in their school's state. Detroit is the 2nd largest metro area in the Midwest, relatively easy driving distance from most of the Big Ten schools, and larger than both the Seattle and Denver markets. Yet, the only 2 Big Ten schools outside of Michigan and Michigan State that have even a Tier 3 connection to Detroit are Northwestern and Purdue. Meanwhile, 10 Big Ten schools have a Tier 3 connection with Denver and 8 of the league's colleges have a Tier 3 connection with Seattle.

In fact, the only instances where a Big Ten school has a Tier 3 connection (much less stronger ones) with a Midwestern market that isn't either Chicago or wholly or partially located in its own state are (i) the aforementioned example of Northwestern and Purdue with Detroit, (ii) Iowa and Wisconsin with Minneapolis, (iii) Minnesota with Milwaukee and (iv) Nebraska and Iowa with Kansas City (which is a market that isn't even in the current Big Ten footprint). That's it... and it's actually even worse when digging deeper because the trading of Badgers and Gophers between Milwaukee and Minneapolis comes with the caveat that there is tuition reciprocity for Wisconsin and Minnesota state residents for their respective flagship universities. In essence, a Milwaukee resident effectively treats Minnesota as an "in-state" school and it would be the same for Minneapolis residents with respect to Wisconsin. As a result, a lot of those Badgers and Gophers are just heading back to their home markets.

If Midwestern metros want to have any chance of changing their slow growth compared to the rest of the country, it's clear that they need to do a better job of attracting the college grads that are just beyond their own home state universities. There really isn't a great reason why Indianapolis isn't drawing at least 1% of grads from neighboring state Big Ten schools like Illinois, Michigan, Michigan State and Ohio State... and Indy is one of the healthier Midwestern economies. Essentially, the Midwest metros with the exception of Chicago have completely ceded their "home field advantage" for Big Ten grads to the coasts and other high growth locations (e.g. Dallas, Atlanta and Denver).

WHAT'S BAD FOR THE MIDWEST MIGHT BE GOOD FOR THE BIG TEN

Paradoxically, the horrific inability of Midwestern markets other than Chicago to capitalize on the pipeline of Big Ten grads that are often within short driving distance is largely a good thing for the conference. The Wall Street Journal database shows that the Big Ten has the most nationalized alumni base of the Power Five conferences from top-to-bottom. As noted previously, the only other conference where every school has at least a Tier 3 connection with New York, Los Angeles, Washington and San Francisco is the Ivy League. More than half of the Big Ten has at least a Tier 3 connection with Atlanta, Boston, Dallas, Denver and Seattle. There are 4 or more Big Ten schools with a Tier 3 connection with Houston, Miami and Phoenix, too.

This helps explain why the Big Ten has consistently received larger media revenue compared to its biggest football rival of the SEC. While the SEC might often receive superficially higher TV ratings compared to the Big Ten, the SEC has much more concentrated intense interest from alums that still live in its home footprint of the South. In contrast, the Big Ten might have a little bit less intense interest in its home footprint of the Midwest/Northeast (outside of places like Ohio), but that's compensated by its very broad presence of alums in large and wealthy markets from coast-to-coast (AKA valuable viewers).

At the same time, to the extent that cable subscriber fees that have been largely based on home market interest are at risk for the Big Ten Network, the Big Ten is still in the best position of any Power Five league to take advantage of any new media rights paradigm due to its more national footprint. The New York Yankees have a combination of national and regional advantages that made them the wealthiest team in the radio era, over-the-air TV era, and cable TV era... and they'll be the wealthiest team in the over-the-top streaming era or whatever else might come down the pike. I believe that the Big Ten will continue in that same type of position in the college sports space - they're the conference that still has the strongest combination of home state passion with a national fan base.

DEMOGRAPHICS AND CONFERENCE REALIGNMENT

Let's get back to the four cities that have a connection with every single Big Ten school: New York, Los Angeles, Washington and San Francisco. If anyone wants to wonder why the Big Ten added Maryland and Rutgers, just look at this data. The additions of those schools were not so much about Maryland and Rutgers actually delivering their respective home markets of DC and NYC, but rather bringing the Big Ten product directly to where the league's alums now live. It's no different than why pro sports leagues are so insistent on having franchises in places like Florida and Arizona: it's not that they are delusional to believe that those markets will have great homegrown fan bases, but rather that they are places where transplants from New York, Chicago and Boston can directly watch their favorite teams.

The underpinnings of the bond between the Big Ten and Pac-12 beyond the Rose Bowl becomes clearer here, too. Not only are Los Angeles and San Francisco uniformly popular for Big Ten grads, but Denver, Phoenix and Seattle also have strong Big Ten connections. The proposed Big Ten-Pac-12 partnership from earlier this decade that ultimately fell apart would have fit right in line with the demographic data.

To be very clear, I don't believe that the Big Ten is anywhere near expansion mode.We likely won't see any real discussion of Power Five conference realignment until the current Big 12 grant of rights contract expires in 2025. That being said, the Wall Street Journal database provides a lot of fodder for which markets make the most for the Big Ten in the event that it wants to expand its footprint further along with some explanation for demonstrated interest in certain schools during recent rounds of conference realignment. The following is simply my blue-sky thinking as opposed to any evidence that there will be realignment moves in the near future.

Texas was mentioned prominently as a past Big Ten expansion target and that was a no-brainer at all levels: a top academic national brand name school with a blue blood football program that delivers a massive high growth population state is the top prize for every Power Five conference even above Notre Dame. The fact that Dallas has a Tier 3 connection with 9 existing Big Ten schools and Houston has connections with 4 conference members is just the proverbial icing on the cake. However, the value wasn't as obvious when Georgia Tech was also identified as a Big Ten expansion target. The Big Ten graduate data partially points to why the league was interested in the Yellow Jackets: the Atlanta market is one of the most prominent destinations for conference grads with 9 Tier 3 connections.

There wasn't much discussion about Colorado being a possible Big Ten school in the past, but Denver has Tier 3 connections with every Big Ten school except for the 4 that are closest to the East Coast. I'm not alarmist about the Pac-12's status among the Power Five conferences (unlike some others) and I won't subscribe to pie-in-the-sky scenarios (e.g. the Big Ten adding schools like USC and UCLA). However, I wouldn't put it past the Big Ten to make a play for Colorado in the next decade if the Pac-12's relatively lower revenue makes it vulnerable. Colorado is an AAU school in a major market with a critical mass of Big Ten alums and even in a state that's contiguous with the current conference footprint (via Nebraska).***

(*** As a reminder, the Big Ten does not have a contiguous state requirement for expansion. The league will jump over states to get Texas, UNC or similar caliber schools if they ever wanted to join. That being said, geographic proximity is certainly an important factor, especially if it's not a blue blood program.)

Kansas is also sitting there from the Big 12 as an AAU school with a blue blood basketball program and Kansas City is one of the few Midwest markets that been able to draw non-local Big Ten grads from multiple schools. I have long been on the record that the most valuable single plausible (e.g. no poaching Florida and USC) expansion scenario for the Big Ten that doesn't involve Texas, Notre Dame and/or ACC schools is the league adding Kansas and Oklahoma. Their smaller markets on paper are countered by having national draws in basketball and football, respectively, along with deeper connections to a lot of major markets beyond their home states' borders (such the OU presence in the Dallas market).

Tank text begins:

Over the past several years analyzing conference realignment, observers have had access to some overarching data, such as TV ratings, athletic department revenue, population and demographic trends of states and metro areas, and the home states of current college students. However, up to this point, there has been only largely anecdotal and/or unreliable data on a critical piece of the conference realignment puzzle: the specific places where the graduates from each college actually live. As an Illinois graduate, I've long known anecdotally that my alma mater sends a critical mass of graduates to San Francisco and Seattle (generally for tech jobs due to the school's strong engineering and computer science programs) while very few Illini move to Indianapolis despite it actually being geographically closer to campus than Chicago and St. Louis, but it has been difficult to find quantitative data to actually back that up.

This is where a new database from the Wall Street Journal fills the gap.* The Journal worked with a labor market research firm to identify the metro areas where the graduates of 445 colleges now live. It breaks down the most popular locations for the alumni for each school to move to in the United States. What's also interesting is to see how certain locations are conspicuously devoid of particular schools' alums, which we'll discuss in a moment.

(* h/t to Aaron Renn for his original post on this Wall Street Journal database. If you're interested in urban development and demographic issues, he is one of the best writers out there.)

For someone that's interested in conference realignment and the college sports business in general, this database is a legitimate treasure trove. As soon as I was made aware of this Journal site, I went through each of the Big Ten schools to identify the top metro areas for each of their respective graduates. Here is the chart I put together with each of the Big Ten schools on top, applicable metropolitan areas listed on the side, and a tier number assigned whenever a market comes up as a top destination for a school's graduates:

Key:

Tier 1 = 10% or more of a school's graduates live in that market

Tier 2 = 5% - 9.99% of a school's graduates live in that market

Tier 3 = 1% - 4.99% of a school's graduates live in that market

Dash = Not a measurable destination for a school's graduates

After creating this chart in my full dorkdom, there are some key takeaways:

FOUR CITIES ARE TOP DESTINATIONS FOR ALL BIG TEN SCHOOLS... AND NONE OF THEM ARE IN THE MIDWEST

There are only four markets in the entire country that drew more than 1% of the graduates from every single Big Ten school: New York, Los Angeles, Washington and San Francisco. None of these metro areas are located in the Midwest. Not even Chicago, the heart of the Big Ten, covered every single conference school, albeit the two sub-1% exceptions are the latest East Coast additions of Maryland and Rutgers.

To be sure, the Wall Street Journal notes that those four particular markets draw from a much wider range of colleges across the country. The sheer sizes of the New York and Los Angeles markets swallow up a lot of college grads and all four of the cities have strengths in industries that attract a national talent pool: finance in New York, entertainment in Los Angeles**, tech in San Francisco, and government and politics in Washington.

(** My favorite Big Ten-to-Hollywood story at the moment: former Penn State basketball player Joonas Suotamo is taking over the role of Chewbacca. Also, while this isn't reflected in the domestic data, the Big Ten will have a monopoly on Americans in the British royal family after this weekend when Hollywood actress and Northwestern alum Meghan Markle marries Prince Harry.)

Still, the Big Ten's top-to-bottom presence in those four markets is noteworthy because the only other Division I conference that has every member in those same markets is the Ivy League... and all of the Ivy League schools are in relatively close proximity to New York and Washington. Interestingly enough, all of the Ivy League schools have at least a Tier 3 presence in Chicago, too.

BIG TEN GRADS LARGELY STAY IN THEIR HOME STATES, GO TO CHICAGO, OR LEAVE THE MIDWEST COMPLETELY

Putting aside Maryland and Rutgers, Chicago is still the market with the deepest ties to the Big Ten by a large margin. It is a Tier 1 market for 6 schools, Tier 2 market for 2 schools and Tier 3 market for 4 schools. No other metro area has more than 2 Tier 1 Big Ten school connections. This isn't exactly surprising with the annual migratory pattern of new Big Ten grads taking over apartments in Lincoln Park and Lakeview every summer (while the older Big Ten grads like me move on to places like Naperville).

Big Ten schools also send a lot of grads to the largest metro areas within their own home states. Every Big Ten school has a Tier 1 connection to at least one market located in its home state. Note that there are many metro areas where the principal city is located in one state but parts of its market are located in another state. New Jersey is a classic example where it's largely split between the New York and Philadelphia metro areas. There are several other border areas in the Big Ten footprint such as the St. Louis metro area being partially in Illinois, the Louisville and Cincinnati metro areas crossing into Indiana. Ultimately, a state keeping a large number of grads from its flagship or other large schools isn't exactly surprising, either. Going home will always be a strong draw.

What's stunning to me, though, is the utter lack of Big Ten grads going anywhere else in the Midwest other than Chicago or a metro area that has a presence in their school's state. Detroit is the 2nd largest metro area in the Midwest, relatively easy driving distance from most of the Big Ten schools, and larger than both the Seattle and Denver markets. Yet, the only 2 Big Ten schools outside of Michigan and Michigan State that have even a Tier 3 connection to Detroit are Northwestern and Purdue. Meanwhile, 10 Big Ten schools have a Tier 3 connection with Denver and 8 of the league's colleges have a Tier 3 connection with Seattle.

In fact, the only instances where a Big Ten school has a Tier 3 connection (much less stronger ones) with a Midwestern market that isn't either Chicago or wholly or partially located in its own state are (i) the aforementioned example of Northwestern and Purdue with Detroit, (ii) Iowa and Wisconsin with Minneapolis, (iii) Minnesota with Milwaukee and (iv) Nebraska and Iowa with Kansas City (which is a market that isn't even in the current Big Ten footprint). That's it... and it's actually even worse when digging deeper because the trading of Badgers and Gophers between Milwaukee and Minneapolis comes with the caveat that there is tuition reciprocity for Wisconsin and Minnesota state residents for their respective flagship universities. In essence, a Milwaukee resident effectively treats Minnesota as an "in-state" school and it would be the same for Minneapolis residents with respect to Wisconsin. As a result, a lot of those Badgers and Gophers are just heading back to their home markets.

If Midwestern metros want to have any chance of changing their slow growth compared to the rest of the country, it's clear that they need to do a better job of attracting the college grads that are just beyond their own home state universities. There really isn't a great reason why Indianapolis isn't drawing at least 1% of grads from neighboring state Big Ten schools like Illinois, Michigan, Michigan State and Ohio State... and Indy is one of the healthier Midwestern economies. Essentially, the Midwest metros with the exception of Chicago have completely ceded their "home field advantage" for Big Ten grads to the coasts and other high growth locations (e.g. Dallas, Atlanta and Denver).

WHAT'S BAD FOR THE MIDWEST MIGHT BE GOOD FOR THE BIG TEN

Paradoxically, the horrific inability of Midwestern markets other than Chicago to capitalize on the pipeline of Big Ten grads that are often within short driving distance is largely a good thing for the conference. The Wall Street Journal database shows that the Big Ten has the most nationalized alumni base of the Power Five conferences from top-to-bottom. As noted previously, the only other conference where every school has at least a Tier 3 connection with New York, Los Angeles, Washington and San Francisco is the Ivy League. More than half of the Big Ten has at least a Tier 3 connection with Atlanta, Boston, Dallas, Denver and Seattle. There are 4 or more Big Ten schools with a Tier 3 connection with Houston, Miami and Phoenix, too.

This helps explain why the Big Ten has consistently received larger media revenue compared to its biggest football rival of the SEC. While the SEC might often receive superficially higher TV ratings compared to the Big Ten, the SEC has much more concentrated intense interest from alums that still live in its home footprint of the South. In contrast, the Big Ten might have a little bit less intense interest in its home footprint of the Midwest/Northeast (outside of places like Ohio), but that's compensated by its very broad presence of alums in large and wealthy markets from coast-to-coast (AKA valuable viewers).

At the same time, to the extent that cable subscriber fees that have been largely based on home market interest are at risk for the Big Ten Network, the Big Ten is still in the best position of any Power Five league to take advantage of any new media rights paradigm due to its more national footprint. The New York Yankees have a combination of national and regional advantages that made them the wealthiest team in the radio era, over-the-air TV era, and cable TV era... and they'll be the wealthiest team in the over-the-top streaming era or whatever else might come down the pike. I believe that the Big Ten will continue in that same type of position in the college sports space - they're the conference that still has the strongest combination of home state passion with a national fan base.

DEMOGRAPHICS AND CONFERENCE REALIGNMENT

Let's get back to the four cities that have a connection with every single Big Ten school: New York, Los Angeles, Washington and San Francisco. If anyone wants to wonder why the Big Ten added Maryland and Rutgers, just look at this data. The additions of those schools were not so much about Maryland and Rutgers actually delivering their respective home markets of DC and NYC, but rather bringing the Big Ten product directly to where the league's alums now live. It's no different than why pro sports leagues are so insistent on having franchises in places like Florida and Arizona: it's not that they are delusional to believe that those markets will have great homegrown fan bases, but rather that they are places where transplants from New York, Chicago and Boston can directly watch their favorite teams.

The underpinnings of the bond between the Big Ten and Pac-12 beyond the Rose Bowl becomes clearer here, too. Not only are Los Angeles and San Francisco uniformly popular for Big Ten grads, but Denver, Phoenix and Seattle also have strong Big Ten connections. The proposed Big Ten-Pac-12 partnership from earlier this decade that ultimately fell apart would have fit right in line with the demographic data.

To be very clear, I don't believe that the Big Ten is anywhere near expansion mode.We likely won't see any real discussion of Power Five conference realignment until the current Big 12 grant of rights contract expires in 2025. That being said, the Wall Street Journal database provides a lot of fodder for which markets make the most for the Big Ten in the event that it wants to expand its footprint further along with some explanation for demonstrated interest in certain schools during recent rounds of conference realignment. The following is simply my blue-sky thinking as opposed to any evidence that there will be realignment moves in the near future.

Texas was mentioned prominently as a past Big Ten expansion target and that was a no-brainer at all levels: a top academic national brand name school with a blue blood football program that delivers a massive high growth population state is the top prize for every Power Five conference even above Notre Dame. The fact that Dallas has a Tier 3 connection with 9 existing Big Ten schools and Houston has connections with 4 conference members is just the proverbial icing on the cake. However, the value wasn't as obvious when Georgia Tech was also identified as a Big Ten expansion target. The Big Ten graduate data partially points to why the league was interested in the Yellow Jackets: the Atlanta market is one of the most prominent destinations for conference grads with 9 Tier 3 connections.

There wasn't much discussion about Colorado being a possible Big Ten school in the past, but Denver has Tier 3 connections with every Big Ten school except for the 4 that are closest to the East Coast. I'm not alarmist about the Pac-12's status among the Power Five conferences (unlike some others) and I won't subscribe to pie-in-the-sky scenarios (e.g. the Big Ten adding schools like USC and UCLA). However, I wouldn't put it past the Big Ten to make a play for Colorado in the next decade if the Pac-12's relatively lower revenue makes it vulnerable. Colorado is an AAU school in a major market with a critical mass of Big Ten alums and even in a state that's contiguous with the current conference footprint (via Nebraska).***

(*** As a reminder, the Big Ten does not have a contiguous state requirement for expansion. The league will jump over states to get Texas, UNC or similar caliber schools if they ever wanted to join. That being said, geographic proximity is certainly an important factor, especially if it's not a blue blood program.)

Kansas is also sitting there from the Big 12 as an AAU school with a blue blood basketball program and Kansas City is one of the few Midwest markets that been able to draw non-local Big Ten grads from multiple schools. I have long been on the record that the most valuable single plausible (e.g. no poaching Florida and USC) expansion scenario for the Big Ten that doesn't involve Texas, Notre Dame and/or ACC schools is the league adding Kansas and Oklahoma. Their smaller markets on paper are countered by having national draws in basketball and football, respectively, along with deeper connections to a lot of major markets beyond their home states' borders (such the OU presence in the Dallas market).